Machine and robot builder OEMs and their end user customers face similar challenges. For OEMs in a highly competitive market, quick machine delivery can make the difference between getting the order and losing it to a competitor.

In a challenging economy, end users tend to take more time making machine upgrade or purchasing decisions.

However, once a decision is made, they may need quick machine delivery in order to get the jump on their competitors and begin seeing a return on their investment.

Time-to-market pressure has increased dramatically in the last two years. Both OEMs and end users are trying to determine how to do more with less, how to integrate innovation into their growth strategies, and how to deliver their products faster.

OEMs and machine builders seek solutions which help them accelerate time to market—such as standardized PLCs, PACs and HMIs—without sacrificing the integrity of their designs or the quality of their equipment. However, this is easier said than done.

Generally, reducing time to market requires certain tradeoffs. There is less time for OEMs to build and test their products and systems, leading to possible pitfalls. These pitfalls seem to be in conflict between their desire to offer machines and equipment which establish differentiation and a competitive edge, and to do so ahead of any competitors.

Quick Delivery Means Market Advantage

“Delivery lead time is often a significant factor in selecting a company to deliver a material-handling system,” said Jeff Hanna, the director of control and software development for Intelligrated (www.intelligrated.com) in Mason, Ohio, in Control Design’s June 2010 cover story, “Seize the Advantage.”

“It’s not always clear that we’ll receive a premium for fast delivery, but it’s often a critical element in deciding who will get the order. In systems that do not offer unique material handling features or software differentiation, lead time will be an especially important factor.” Intelligrated designs, builds, installs, programs, and supports material handling systems for distribution centers and manufacturing systems.

“Delivery time is always important,” agreed Tom Kleeman, CEO at Spartanics (www.spartanics.com) in Rolling Meadows, Illinois, in the cover story. “On occasions, it seems that it’s the only consideration.”

Spartanics designs and builds equipment for the printing and converting industries. The company’s product offerings extend from standard counting and press-feeding equipment to custom laser-cutting systems. Spartanics faces the same pressures many other OEMs and machine builders face: Machine orders are down, but when the orders do come in, customers want the machine yesterday.

“Our customers may have contractual obligations that put a lot of pressure to get equipment in place and in production in a timely basis,” said Kleeman in the Control Design cover story. “In other cases, the customer has calculated a payback for the investment and is anxious to start the clock as soon as possible.”

The same is true for Saber Engineering in Auburn, Calif., which builds material-handling work cells and wafer robotic transport stations for companies in electronics, solar, and general manufacturing industries. “In 30% of the cases, delivery time is given the highest priority in awarding the project,” said Bob Sullivan, Saber Engineering’s vice president in the Control Design cover story. The work cells that Saber builds use various robotic, servo, PLC, HMI, and vision systems to perform automated tasks.

Offering products or features that others don’t can give machine builders a competitive advantage. Such is the case for BioAutomation (www.bioautomation.com), a manufacturer of DNA synthesizers in Plano, Texas. “We are lucky in that our market is small and there are not many people for them to go to,” said Jeff Strauss, the company’s vice president. “There are competitors in certain sections of the market we serve, but no one else covers the range of the market that we do.” However, Strauss is quick to add that customers may desert the machine builder if they can’t deliver quickly.

Cutting Time to Market is Risky Business

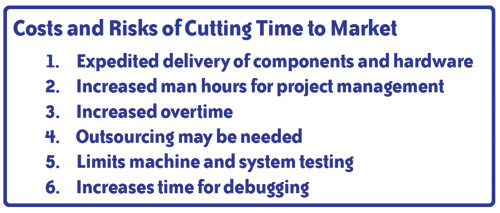

Sometimes machine builders can command higher prices when their customers demand shorter lead times, but not always, especially in tight economic markets. However, even if OEMs can get quick-delivery bonuses, the prize may not be worth the consequences. “The larger factor could be risk,” Hanna said in the Control Design cover story. “Despite the product strategy and type of sophisticated tools we use, risk increases because the time to test the systems often is reduced to meet schedules. The added costs can be quantified, but the risk is much harder to quantify.”

When OEMs build machines for fast delivery—especially custom machines—there are usually certain tradeoffs such as features, testing, or quality. Also, it usually costs OEMs more to build machines quickly. “Often we have to write software with incomplete or not fully tested hardware,” said Bob Fung, director of engineering at Owens Design (www.owensdesign.com) in Fremont, Calif. in the cover story. “Material is selected to minimize design, build, integration and test time—sometimes at a much higher cost.” Owens designs and builds automated manufacturing equipment for the semiconductor, hard disk drive, and solar industries. Most of the 12 to 15 systems a year that Owens designs and delivers require short delivery times.

OEMs in the robotics industry face the same issues. Rick de Jong is the general manager at AEMK Systems (www.aemksystems.com). The Waterloo, Canada, company specializes in high-speed, vision-based robotics systems for automation, assembly, and packaging applications.

“In general it costs more to cut time-to-market because you need to increase resources to meet shorter deliveries,” De Jong said in the Control Design cover story. “Additional costs can be quantified in increased labor rates due to overtime pay, additional outsourcing due to inadequate labor resources, and potential increases insupply-chain cost to accelerate deliveries of raw components.”

Service after the sale can pose additional risks down the road. “If the machine is a one-off custom solution, quick project turnaround could mean that we’re in a weaker position when field support is required,” said Kleeman in the cover story. “Some of this is unavoidable. If we have limited time to build and test a system, then 12 or 18 months later, it’s more difficult to diagnose a problem.”

Automation and Standardization Offset Cost and Reduce Risk

Machine builders can deal with fast delivery times as well as trim costs by using modern, off-the-shelf automation instead of designing custom controls. Fung’s advice is to select off-the-shelf components or building blocks rather than custom automation, select components and systems that reduce wiring effort and debug time, and design systems that require less software customization.

Saber Engineering’s Sullivan agrees: “Cutting time-to-market means overtime on the design, modified component selection, and expedited fees for equipment,” Sullivan said in the cover story. “It generally costs 15% to 25% more to expedite a schedule by 10% to 15%, but most customers will pay for an expedited schedule. Using standardized equipment, components and software that are off-the-shelf helps reduce expediting costs, and that means more profit.” Sullivan added that having standard equipment and standard designs with known delivery schedules in place is vital. Saber’s transport station uses industry-standard PLC and HMI products to speed time-to-market.

Port Orford, Oregon-based NC Electronics (www.omniturn.com) achieves quicker build times by modifying its basic machine to meet custom requirements. The company uses a modular building-block approach to building automation into its Omniturn CNC machines. “We build our machines to a certain point and leave flexibility for quick customization,” said George Welch, Omniturn’s CEO, also in the Control Design cover story. “This keeps the cost down. We also try to use off-the-shelf automation from prior projects. If you have a mature product with a well organized production process, there is no downside.”

AEMK Systems has a similar approach. “Our DeltaBot technology was designed specifically with short lead times in mind,” de Jong said in the cover story. “Our ability to minimize mechanical components, maximize resources due to inherent design features, and provide the correct talent in the indirect labor segment greatly accelerates build time.”

Kleeman said that for automation system designs—capturing and communicating design intent as early as possible can accelerate build times because parts are fabricated sooner, components are purchased earlier, and mistakes are minimized. “With shorter build times, you become risk-adverse and tend to stick with hardware and systems that you know,” said Kleeman. “Sticking with that solution can be cheap insurance, especially when there are other technical risks in the project that aren’t so easily mitigated.”

When talking about the machine controls, “minimizing the learning curve is all important,” Kleeman continued. “The automation vendor can be a hero for us if he’s willing to help us along as we build our application.”

“With a reduced build time, selecting a common platform that is well understood is the best choice,” Sullivan said in the cover story. “This reduces the spin-up time needed to become familiar with a new product. Equipment delivery time is also a key factor, as many times you need the equipment yesterday. We try to use more all-inclusive automation packages that have many of the functions and features required by our customers. This cuts development time and ultimately time to market.”

Don’t Sacrifice Quality for Speed

Typically, faster time to market can provide a competitive advantage to most machine builders. However, quick delivery must not impact machine quality and reliability. It’s important for OEMs to know, understand, and communicate the extent to which they can deliver equipment realistically. “We’re not willing to commit to schedules we don’t believe are achievable, and we’ve lost programs because of this,” Fung said in the Control Design cover story. “In a number of cases, the customer selected a supplier because of lead time and came back to us since the machine that was delivered on time didn’t work months later.”

Accelerating time-to-market means that there is not as much time to cover design aspects in an effort to avoid unintended consequences. “The more time you take, the higher the quality and consistency,” said Strauss. “Obviously, you have to find the correct balance for each project based on complexity and market pressures.”

Using standard off-the-shelf automation components such as PLCs, PACs, and HMIs can help speed up machine development time, reduce errors, increase profit margins—while ensuring high-quality, consistent and reliable machine designs.

By Jack Smith

The Hebert Agency

Originally Published: September 2010